Why Financial Services Hesitate (But Shouldn’t)

It’s understandable why some financial institutions are cautious about Facebook Ads. Concerns like privacy, compliance, and audience trust are real.

But here’s the truth:

Over 2 billion people use Facebook daily—including high-net-worth individuals, small business owners, and first-time investors.

With the right strategy, Facebook Ads can:

- Build trust in your brand

- Generate qualified leads

- Educate potential clients about your services

- Compete with modern fintech startups

1. Who Can Benefit?

Facebook Ads work especially well for:

- Banks & Credit Unions promoting local services

- Insurance companies offering personal or business coverage

- Fintech apps looking to drive app installs or subscriptions

- Financial advisors targeting specific income levels or life stages

- Loan providers seeking lead generation with filtering

2. What Makes Facebook Ads Effective for Finance?

Precise Targeting

You can target:

- Age, income, job title (e.g., business owners, freelancers)

- Life events (just married, new home, recently moved)

- Behaviors like online banking or financial news engagement

Lead Generation Ads

With built-in Facebook forms, you can collect info like:

- Name, email, phone

- Preferred consultation time

- Type of service interest (mortgage, investment, retirement, etc.)

Custom and Lookalike Audiences

Upload a customer list to retarget or find similar users with high lifetime value (LTV).

3. What to Include in Your Ad Strategy

Educational Content Converts

People don’t just want promotions—they want clarity. Use ads to:

- Explain investment basics

- Offer free financial planning guides

- Share case studies or success stories

Professional Visuals Matter

Use:

- Real staff photos or consultants

- Charts or clean infographics

- Video explainers on financial products

Trust Signals

Build confidence by including:

- Testimonials

- Data protection statements

- Certifications (e.g., FCA, SEC-compliant)

4. Navigating Ad Policies & Compliance

Financial services are under strict Meta ad review.

Make sure to:

- Avoid misleading claims (“Guaranteed returns”)

- Add disclaimers or regulatory links when required

- Be transparent in ad copy

- Choose the correct category (e.g., credit, loans)

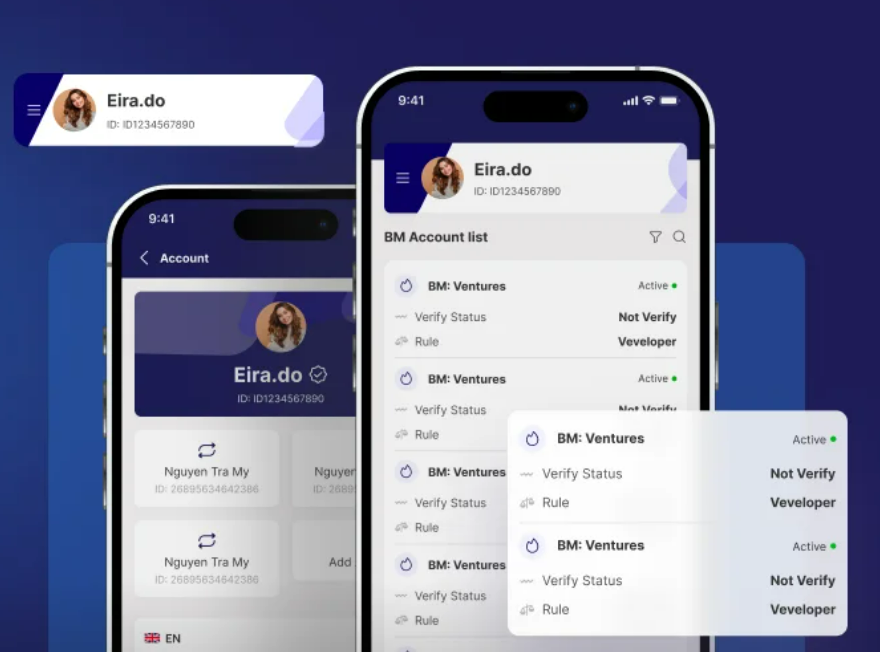

Pro Tip: Use a campaign management platform like Adsspeed to monitor ad rejections, performance, and creative approval status across multiple regions.

5. Case Examples (What Works)

✔ A local credit union promoted low-interest home loans with video testimonials and got 320+ qualified leads in 3 weeks.

✔ A fintech budgeting app ran UGC video ads showing daily savings tips—CPI dropped 28% in Q2.

✔ A retirement planning service used carousel ads with real client journeys segmented by age groups.

Final Verdict: Yes, Facebook Ads Work for Finance—If Done Right

Facebook Ads offer financial services a rare mix: wide reach, smart targeting, and measurable ROI.

To succeed, you must:

- Stay compliant

- Lead with education and trust

- Target carefully

- Test and refine creative for relevance

With tools like ads check speed for creative performance and Adsspeed for managing multi-regional campaigns, your finance brand can go beyond awareness—and drive meaningful growth.

🔹 Google Chrome Store: Search “Ads Check Speed | adsspeed.com”

https://chromewebstore.google.com/detail/ads-check-speed-adsspeedc/bhfahbbgppclfpeapkaebjbcffjnahcd

🔹 IOS Download : https://apps.apple.com/vn/app/adscheckspeed/id6742325139

🔹 Android Download : https://play.google.com/store/apps/details?id=com.dev.fbadsspeedv2&hl=vi